(M.Sc. Economics, NMIMS – Mumbai 2018-20)

Connect with Areesha

on LinkedIn

The other day I received an SMS saying invest Rs. 5,000 every month till the age of 60 and get Rs. 30,00,000 lump sum and Rs. 25,000 every month post the age of 60. I am sure every one of us is bombarded with these kinds of messages every other day. There are several online calculators available to check how much you should invest now to get the desired amount at the age of retirement. But what if you don’t have that much amount to invest in? Also, do you know much return your current investment should earn to generate a corpus for your retirement? To be honest, I didn’t know so I guess we are sailing on the same boat.

So without wasting any time, let’s see how can you use our tool to know the Return on Investment (RoI) required on your current investment to generate a corpus for your retirement in just 3 steps. Download the sheet from here.

What are the objectives of this sheet?

The whole purpose to build this sheet is to tell you how much return your investment should earn so that you can generate the desired corpus for your retirement.

What are the questions will be answered by this sheet?

You will know how much RoI needs to be earned on your investment. You will also know the amount you require to retire with. It also calculates your per annum post-retirement expense.

For illustration purposes let us assume there’s someone called Mr. X. He is 25 years old. He wants to retire at the age of 60 and expects to live till the age of 85. His current salary is Rs. 95,000 per month.

Follow the below steps to get your questions answered:

Step 1: Enter your personal details

Here, you are required to enter your current age, age at which you want to retire and age till which you are expected to be alive. Please note, this sheet is designed for a person who is more than or equal to 25 years old and expected to live till the age of 99.

Step 2: Enter your per month income and expense

In this step, you are required to enter your current per month salary. Expected every year increment in salary and bifurcation of a monthly expense. Please note: It is required that saving as a percentage of income to be more than or equal to 15% (Otherwise person either has to increase his salary or reduce his expense)

Step 3: The easiest step among all

One only has to press submit the inputs enter by one.

The output of the sheet:

The Output indicates how much person has invested till retirement and what RoI he should target on his investment. If a person manages to get the RoI calculated by this sheet, he can achieve his corpus by the time he retires. ( Basically, in this case, Mr. X has invested Rs. 1.44 Cr. till 60 years and he has managed to get RoI of 12.44% on his investment. So at the age of 60, he has generated a corpus of Rs. 20.26 Cr. which will take care of his post-retirement expense.)

Following are the few assumptions made by me while preparing the sheet. Please refer the same.

Let’s look at the Expense tab:

Expense sheet indicates how your expense will grow over a period of time. To be on the safer side I have considered 13 months as annum. I have also considered growth rates of each expense heads will remain the same for a decade and will be revised by 0.5% compounded annually (Can be edited as per your requirement).

Salary and investment tab:

We know our annual salary and annual expense. Annual saving is just a difference between income and expense. I have kept 5% (editable input) aside as an emergency fund which will be kept aside in savings account. Available per month funds to invest is remaining funds in hand after the emergency fund is kept aside. Now, Corpus generated is a sum of funds in hand and money parked in a savings account. (Note: Funds in hand should fetch min. RoI as shown in the output box)

Corpus tab:

Corpus sheet indicates post-retirement annual expense and how that corpus will be depleted over a period of time to cover your expense. Here I have considered the generated corpus will fetch 3% post-tax return on the corpus (Pre TAX savings return is 4% -editable input).

Hope this article has helped you to understand your target RoI on current investment and required corpus to retire on desire age. Let me know topics you would like me to cover in next post in the comment section below.

National Spot Exchange Limited (NSEL), the first Electronic Commodity spot exchange of India, was incorporated in May 2005. NSEL was a subsidiary of 63 moons technologies limited, then known as Financial Technologies India Limited (FTIL) which was founded by Jignesh Shah.

The then Prime Minister’s vision to create a single market across the country for both manufactured and agricultural produce was the reason for NSEL to be conceived.

NSEL commenced its operations in October 2008. Its operations included providing an electronic platform to undertake spot trading of commodities. The then Managing Director of NSEL, Anjani Sinha announced that the NSEL had launched gold, mini gold, silver and cotton contracts, and more commodities were to launched in every following week.

The case came into light when NSEL made a payment default on the orders of the Forwards Market Commission (FMC) to stop launching any fresh contracts. This led the Exchange to abruptly shut down in July 2013.

According to the rules of FMC, the ‘SPOT’ contracts needed to be settled within 11 days. In other words, the entire transaction including delivery of the commodities as well as transfer of money should be settled in 11 days. Thereby, keeping the transaction as ‘Spot’ and not a ‘Forward Contract’.

What exactly happened?

NSEL supposed to make just T+2 contracts which were spot in nature. But NSEL did not abide by the guidelines. They designed multiple contracts such as T+25 or T+36 contracts. These contracts were forward contracts and NSEL was not authorised to make such contracts. But they did and no one stopped them.

NSEL made paired contracts and termed them as Arbitrage contracts. Investors assumed the arbitrage to be guaranteed as NSEL as an exchange stood guarantee. The brokers sold such arbitrage contracts to the customers where they could Buy the T+2 contracts and sell the T+25 contracts.

A long term contract usually has a higher price as compared to a short term contract. Thus the T+25 days contract was priced higher than the T+2 contracts. Thus the pattern of contract for the customers was that they purchased the T+2 contracts and sold the T+25 contracts. Now on the second day, they took the delivery of the commodities and stored them in the NSEL warehouse. Further on the 25th day they provided delivery of those commodities to whom they had sold the T+25 contracts. The price difference produced almost 15-18% net return to the investor after deducting storage charges, VAT, etc.

This went on for two years resulting in NSEL to generate high revenues. The number of customers to escalate to around 15000, who put in at least INR 2 lakhs, in order to earn higher returns.

Now the issue that arose was that these contracts were always executed in pairs. None of the investor was allowed to take just one side of the contract i.e. either purchase or sell. The brokers reported to have sold the pair contracts in the format of purchase on the near side while sell on the far side.

What stopped them?

Exemption was provided to spot exchanges like NSEL and NCDEX by the Forwards Market commission (FMC), for one day carry forward facility. Although, the day limit was not specified in the law, the rule stated that the contract should not surpass the 11 day trade settlement.

The Ministry of Corporate Affairs issued a show cause notice dated April 27, 2012, to NSEL for certain clarifications regarding the trades. Further on the orders on the Department of Consumer Affairs (DCA), NSEL suspended trading in all but its E-Series contracts as on 31st July 2013. NSEL would not launch any new contracts and the existing contracts were needed to be settled on the due date.

As seen earlier, there were investors who had purchased commodities on the T+2 contracts. These investors expected that after 25 days their sell contract would actuate and they would be paid back money from the sell contract.

According to Anjani Sinha, the MD, there were 40 live contracts out of the 86 contracts they launched in various commodities which had settlement period of over 11 days.

This resulted in the INR 5600 crore settlement crises in July 2013.

In August the FMC ordered Financial Technologies India Limited to appoint a reputed Forensic auditor firm to establish the creditability of the Books of accounts authenticate the commodity stock it had in the warehouses with the records. It was also in news that FTIL in a draft audit report suggested system and process improvements in some of NSEL’s departments.

Choksi and Choksi was the audit firm who was provided with the assignment of NSEL. In the audit report, they had provided a clean chit regarding the E-series contracts on NSEL. The FMC gave a No Objection Certificate for the E-Series settlement. Thus 40,000 genuine claimants of E-Series received benefit.

The audit report which came down heavily on NSEL stated that the NSEL had no mechanism to monitor the activities of the custodians in respect of quality, quantity or verification of underlying stock except for the two audit conducted in the past in December 2012 and March 2013. In many cases the collateral was just inadequate or just missing leading to the settlement crises.

In October 2013, Amit Mukherjee (Former Vice- President, Business development NSEL) was the first to be arrested by the Economic Offenses Wing (EOW) of Mumbai Police. Further arrests were of Jay Bahukhandi (Former Assistant Vice President, NSEL) and Anjani Sinha (Former Chief executive of NSEL).

Who were actually opposite the investors?

Opposite to the investors i.e. who were supposed to sell the contracts of T+2 and purchase the contracts of T+25 were revealed quite later. In reality they were just 24 who used the paired contracts pattern to raise money easily.

One of these 24 was Nilesh Patel, the Managing Director of NK Proteins Limited, supposedly the first borrower in the NSEL Scam. He was arrested by EOW in October but subsequently got out on bail. Raised funds under the garb of the contract without depositing any collateral in the warehouses. The amount earned by NK Proteins due to the above contracts were utilised for expansion purposes and a castor oil joint venture with Adani group. It had deployed around 333 crore of the investor’s money it earned into the joint venture contract.

Some of the other defaulted borrowers who were also arrested include – Arun Sharma (Lotus Refineries), Surinder Gupta (PD Agro), Indrajit Namdhari (Namdhari Foods), Kailash Aggarwal (Ark Imports), Narayanam Nageswara Rao (NCS Sugar), B V H Prasad (Juggernaut Projects), Varun Gupta (Vimladevi Agrotech), Chandra Mohan Singhal (Vimladevi Agrotech), Ghantakameshwar Rao (Spin-cot Textiles)and Prashant Boorugu (Metcore Steel & Alloys).

What about the Brokers?

In November 2016, on the orders of the Ministry of Corporate Affairs, the Serious Fraud Investigation Office (SFIO) conducted investigations for the alleged irregularities in the NSEL Scam. SFIO is a multidisciplinary organisation which is involved in detecting white collar crimes. It recently submitted a report to the government stating that all the 148 member brokers of NSEL had earned ‘Unlawful Gains’ while their clients had to suffer ‘illegal Losses’.

SFIO wanted the Securities and exchange Board of India (SEBI) to put the commodity broker houses or their promoters or their directors through the ‘Fiat and Proper test’. SFIO also suggested the government to begin the ‘Winding Up Process’ of the 148 broker firms as they had been conducting business in a fraudulent manner.

The brokers had been accused for indulging in manipulation of client KYCs large scale modification of client codes on multiple deals as well as infusion of unaccounted money via their NBFCs. They made false representations of assured and risk free returns to clients.

Accused of the alleged role in the NSEL Scam of about INR 5600 crores, Criminal proceedings were initiated by SEBI against about 300 brokers.

Show cause notices were dispensed by SEBI to top 5 broker firms namely Anand Rathi commodities, India Infoline Commodities (IIFL), Geofin Comtrade, Motilal Oswal Commodities and Phiilip Commodities. The charges issued were mis-selling of NSEL contracts as they promised assured returns without ensuring delivery. Further they were also issued second show cause notices when SEBI was not satisfied with their explanations offered on the mis-selling allegation. SEBI said that these broker firms seemed to have a close association with the paired contracts and NSEL as they facilitated the paired transactions for their clients.

Nearly two years after it issued the show cause notices, Market regulator SEBI, Motilal Oswal and IIFL Commodities as ‘Not Fit and Proper’ and they shall cease to act as a commodity derivatives broker. In the orders uploaded by SEBI on its website, Motilal Oswal and IIFL had a close connotation with NSEL and allowed themselves to become a part of the network.

“Thus…the notice is not a fit and proper person to be granted registration to operate as a commodity derivatives broker,”

said the SEBI order.

SEBI also ordered that the clients of Motilal Oswal and IIFL Commodities need to withdraw or transfer the securities held by them with the broker within 45 days at no additional cost.

Motilal Oswal in a statement said that they too were the victim of the scam like thousands of other investors. They also claimed to have its own group investment of around INR 57.8 crores due from NSEL on the date of default. They would explore legal options as they were aggrieved by the order and also the order would not have any impact on the overall business of the company.

India Infoline Commodities Limited did not have any outstanding dues from NSEL, but would also explore legal options being aggrieved by the order.

In case of IIFL only 0.06% of its total business is in commodity trading and a 326 crore exposure to NSEL. While Motilal Oswal had a 263 crore exposure to NSEL.

Both the companies are likely to appeal the directions in the Securities Appellate Tribunal (SAT), according to the officials of the two firms.

The next to be declared as ‘Not Fit and Proper’ were Geofin Comtrade (Formerly known as Geojit Comtrade) and Anand Rathi Commodities (ARCL) by SEBI on 26th February 2019.

According to a report, Geofin Comtrade had an exposure of about INR 290 crores while ARCL had an exposure of INR 591 crores against NSEL.

Phillip Commodities India was the latest and fifth broker that SEBI declared as ‘Not Fit and Proper’.

The clients of Phillip Commodities, Geofin Comtrade and Anand rathi Commodities were given the same order to withdraw their funds or securities within 45 days. If they failed to do so the broker would transfer it within 30 days thereafter.

SEBI said that even though the broker firms were yet to be established in court, it is justified to keep a person in doubtful reputation out of the market rather than having the risk of market to get affected.

Fear looms around the other broker firms named by various investigating agencies as similar actions would be taken for their alleged involvement in the NSEL Scam.

Let’s start with, what is an Artificial Neural Network?

An Artificial Neural Network or ANN is a software program that mimics the human brain’s ability to classify patterns or to make predictions or decisions based on past experiences. The human brain relies on inputs from the five senses, while the artificial neural network uses inputs from data sets. ANN have three or more layers of neurons. The first layer of neurons, called the input layer, has one neuron for each input to the network. Each neuron in the input layer is connected to every neuron in a hidden area. The hidden area occasionally consists of more than one layer, in which case each neuron in the first hidden layer will be connected to every neuron in the second hidden layer. The last layer in the hidden layer is connected to the outer layer. The strength of the connection between the various neurons varies with the weights allocated to each of the inputs. To start with a neural network, you would typically define a function that would map any value to a value between 0 and 1. This is called a “Sigmoid” function.

This function will be run at every neuron of our network, it is useful in converting probability out of numbers. Then after you add the input, you would like to seed them to make them deterministic as you would be adding random weights. Then you would add the synapses (synapses are the connection between each neuron in one layer to another neuron in another layer). Each synapse has a random weight attached to it. As you train this neural network, the error rate will go down as the allocation of weights which were initially random would autocorrect to a more accurate value.

Selection of appropriate inputs is one of the biggest challenges while designing a neural network. Selecting which inputs will impact NIFTY 50 is a relatively tougher job than selecting inputs for which mortgage application is most likely to default. Because both inputs and target outputs used in time series forecasting are very noisy (the data has a lot of random movement that has nothing to do with the trend). The data used in rating mortgage application are usually more generalized. If there is no income in that month, the person will default. However, in a time series forecast, the NIFTY 50 could go down today and come back up tomorrow and remain up for two months. Is it possible to claim that this fall in NIFTY 50 just noise? Credit Card customer search is another domain where neural networks are used because they require very specific customers to sustain. This ideal customer should spend heavily and not use revolving credit line. Hence, per card revenue will be below per card cost which will result in a lower breakeven point. This is crucial for a bank as the incidental & incremental exceed the revenue resulting in a non-profitable business. Therefore, implementing neural networks to distribute credit cards will maximize profits.

MJ futures claims that they achieved a return of 199.2% over a 2-year period using neural networks. Neural networks can identify trends in data that humans might not notice. For example, Dean Barr and Walter Loick at LBS Capital Management using a neural network with 6 inputs. One of these inputs is the ADX, which indicates the directional movement over the previous 18 days. Two more of these inputs are the current value of the S&P 500, and the net change in the S&P 500 value from 5 days prior. It has also been observed that with a network with 3 hidden layers and 20-40-20 neurons in hidden layers was the optimized network with an accuracy of 94.08% for validation dataset.

One of the most common mistakes that most traders make is taking Standard Deviation as their volatility in all their calculations. However, this is a backwards-looking figure and not an accurate anticipation of the future. To solve this figure an implied volatility could be used or volatility using an Artificial Neural Network. This was done in Shaikh A. Hamid and Abraham Habib’s paper on “Financial Forecasting with Neural Networks”, where they discovered that volatility forecasts as per ANN are more accurate than Barone-Adesi and Whaley (BAW) for pricing American options on futures.

India’s GDP

If we look into the downfall of India’s GDP in 2008 and 2012 there was a huge downfall. And currently, it is also showing downtrend which can show us that in the near future there are chances of GDP going further down and some other indicators support the fall in this GDP.

There are some factors which are making us believe that there is a huge chance of recession in the near future.

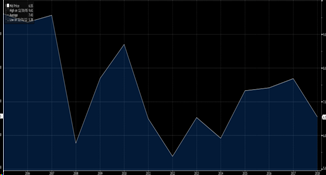

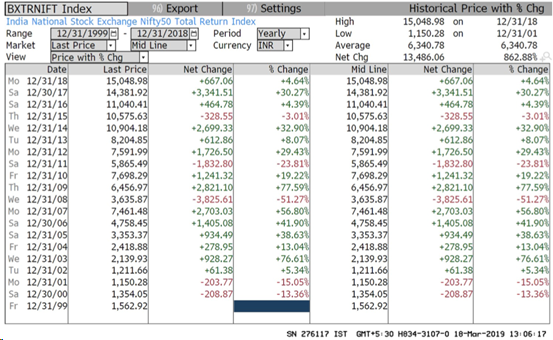

Nifty Returns

As we can see in the table below, there has been a reduction in the return given by the markets in the years when the GDP Growth rate is low. This clearly suggests the positive relation between market returns and GDP Growth rate

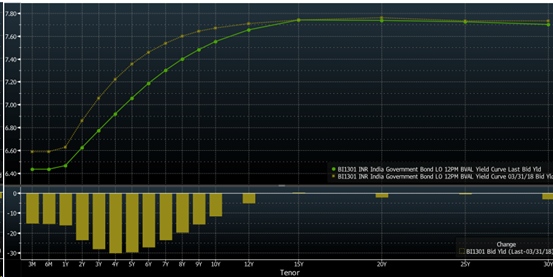

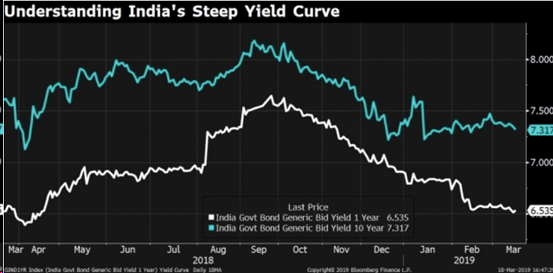

YIELD CURVE

If the difference between the interest short run and long-run interest rates starts to reduce, it means that the economic position is weakening. The yield curve is steeper for India and the growth rate of India is diminishing.

If we see the graph above, though the difference has increased it is presumed to converge in the near future and can lead to a slowdown in India’s economy.

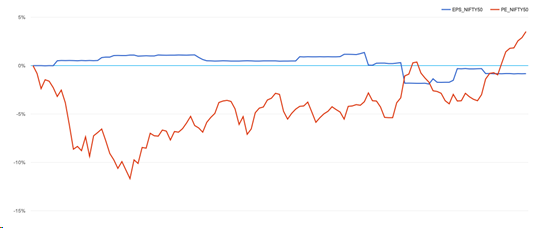

P/E and EPS

The red line indicates the P/E, P/E ratio has crossed the EPS line, this can be indicative that the index is overvalued and can fall in the near future. As in a period of 6 months, the market has been performing good but P/E didn’t cross EPS. So if the correction comes in the market there are chances of the market falling.

These are some of the indicators which may predict a slowdown in the recent future if the indicators tend to state the information in a similar way and do not diverges.

Unemployment Rate

According to experienced economists, the unemployment rate has been at 45 years high. In 2018, the unemployment rate rose to 6.1 %.

If we see, in the year 2008 the unemployment rate was at a maximum of 4.116%. Now it is way higher than the last few years. So this is one of the indicators stating the downtrend in India’s GDP in current and upcoming years.

Chances of war with Pakistan?

Since 1947 partition, India and Pakistan have come across there have been many reasons for conflict between India and Pakistan. There are huge chances of Indo-Pak war, because of ceasefire violation. On 14th Feb 2019, terror strike which lead to the death of 40 Central Reserve Police Force personnel were killed on Feb 14, 2019. After 12 days of Pulwana attack, India strike on Jaish-e-Mohammed on Pakistan soil which lead to a huge tension between India and Pakistan. This tension if continues can hamper the growth rate of India and somewhat indirectly contributing to the recession.

Oil Shock

Rebounding oil prices have pushed up oil import costs and will widen India’s currency account deficit. This will, in turn, weigh on the rupee, which is expected to depreciate further, economists say. India could overtake China as the world’s largest oil demand growth centre by 2024, according to a Wood Mackenzie report. Oil prices have shot up this year, and are set to go up further when sanctions on Iran kick in. The increase in oil prices and India being one of the largest importers of crude oil, can lead to an increase in the current account deficit and hence, contributing to the downfall in India’s GDP.

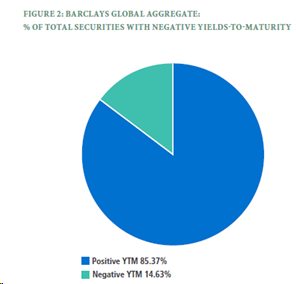

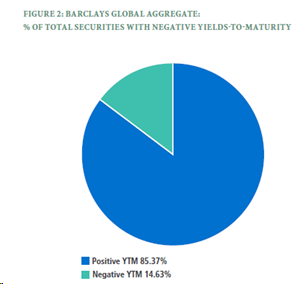

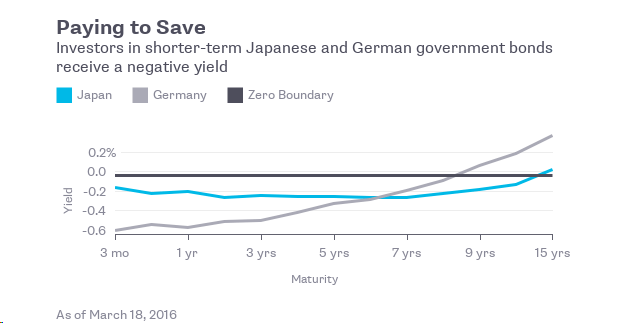

Is the Eurozone heading towards a fate similar to Japan with sticky disinflation, negative interest rate, asset purchase extravaganzas? Can we still generate positive returns from the European sovereign credit markets with relatively low risk, in such a negative yield environment wherein almost 14.63% of bonds have a negative Yield to Maturity (YTM) (Out of which 73% of negative YTM bonds have been issued by Western European countries such as Germany, France & by Japan in Asia)?

Active management of bond portfolios can help us effectively navigate through this negative yield environment and generate better than expected returns on our investments. In order to select the optimal active bond management strategy for the European sovereign credit market and to learn how we as investors can leverage the same, we need to understand the fundamentals of the economic prospects of the nations in the Eurozone and how they might be in the same boat as the BOJ.

Eerie Similarities

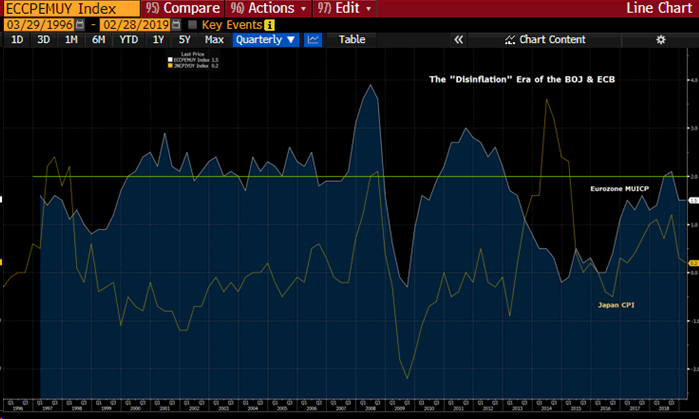

The “Disinflation” Era:

Both the European Central Bank (ECB) and the Bank of Japan (BOJ) are struggling through sticky disinflation with the CPI (Consumer Price Index) undershooting their 2% target for most of the past decade. In order to prop up inflation to healthier targeted levels of 2%, the BOJ & ECB both have implemented numerous & sometimes even outrageous policies which sound absurd at first such as negative interest rates, asset purchases (equity & debt), loans at ultra-favorable terms & last but not the least the “Yield Curve Control” by the Bank of Japan (BOJ).

Let’s dig a little deeper to understand how these policies affect the European credit markets and how can use them to structure our trade.

“I want to borrow money & want you to pay me for the same”

If I came to you with the above proposal, you would probably think I’m crazy to even think about it. For years, economists and central bankers have had to deal with the problem of Zero Lower Bound (ZLB) on interest rates, which in turn restricts the extent to which central banks can stimulate the economy by managing monetary policy by navigating interest rates.

To counter this problem, Haruhiko Kuroda (Central Bank Governor, BOJ) & Mario Draghi (President, ECB) implemented this novel idea of “negative interest rates”. Negative interest rate here refers to the deposit rate i.e. the return banks get on their excess reserves (IOER) parked with the central bank. The whole motive behind this move was to disincentive banks from holding excess reserves and extend more credit to the economy. They expected this policy to amplify expenditure, wages and hopefully inflation. However, due to ageing demographics, low business confidence, lower credit demand growth and shrinking bank margins, inflation expectations have been consistently anchored below targets.

“Sir, what would you like to buy today? Japan, please”

Since negative interest rates were struggling in the background, the central banks started buying financial assets such as equities & bonds from the secondary market in order to inject liquidity. The expectation was that if the central bank buys bonds from investors, investors will expend the cash received and there will be scope for higher inflation through higher spending as they likely won’t invest the proceeds in negative yielding instruments available within the country.

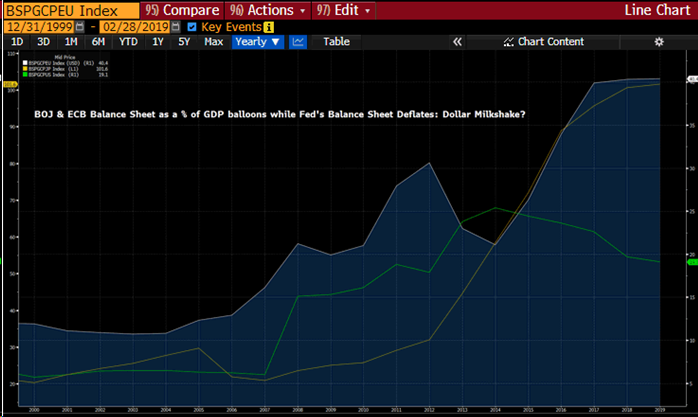

With these expectations, the BOJ (yellow) ballooned its balance sheet away to as much as 100% of GDP! ECB’s assets as a % of GDP (white) have also jumped from 20% to 40% in the last decade. So while the ECB and BOJ were filling the glass (economy) with their rich milkshake (money), the Fed (green) decided to switch off the tap and replace it with a straw. In other words, most of the liquidity or money injected through the above policy measures found itself gravitating towards the US which officially stopped it’s balance sheet expansion and in fact started to “normalize it’s balance sheet”, effectively withdrawing liquidity. This lead to lower spending in the European economy and thus a muted inflation print. The phenomenon is also known as the “Dollar Milkshake Theory”, but that’s a topic for some other post.

“Are you a control freak? BOJ is.”

So in order to have control over the yield curve (which in turn heavily affects borrowing costs and thus spending & economic activity through credit demand), you’ve flirted with negative interest rates, went on an extravagant asset purchase spree, but nothing worked. So what do you do now? You not only control short term borrowing costs but also the long end of the yield curve. BOJ anchored the short end around -0.2% and the long end around 0% with a +/- 0.1% range by claiming to buy unlimited quantity at the upper end, to keep interest rates low for long. They expected this to maintain the steepness in the yield curve which could help soothe banks’ declining margins as they could now lock in a better spread. It would also support asset prices and build consumer confidence.

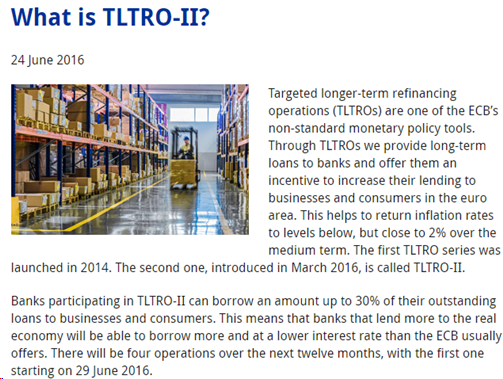

Now since Draghi has been following the footsteps of Kuroda and is probably in the same boat as him, he also might consider pulling a YCC trick out of his hat considering the end of his asset purchase program in December 2018. He even announced the launch of TLTRO-III (Targeted Longer Term Refinancing Operations) in the March 7, 2019, monetary policy review. Both of which, could help maintain an upward sloping yield curve and low yields.

The biggest beneficiaries of the asset purchase program and TLTROs are usually the nations which have the highest holding the ECB’s capital key with Germany, France, Spain & Italy being the top contenders.

For those who aren’t aware of the TLTRO program, here’s a brief explainer from the ECB website.

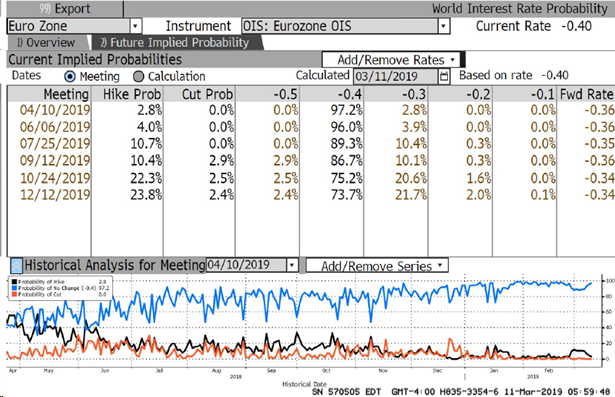

Since Germany is going to be one of the biggest beneficiaries of TLTROs as mentioned earlier, we can expect further easing in the nation, while interest rate risk from hikes seems to be subdued for the rest of the year. (Interpreted from the market-implied probability of interest rate changes).

Since the setup for Germany is ready now, considering soft inflation, low-interest rate risk, upward sloping yield curve & negligible credit risk (AAA rated), we can employ a strategy known as “Roll Down” or “Rolling down the yield curve” to enhance our returns within a short horizon of 1 to 3 years rather than just blindly accepting a 0% or even negative YTM on short-dated bonds by just holding them till maturity.

The strategy involves the purchase of a bond with a maturity in the higher yielding section of the yield curve and selling the bond prior to maturity when it reaches a lower yielding section.

The strategy can benefit investors by providing:

1. Higher incremental income: Purchasing bonds with a higher current yield

2. Higher capital appreciation through liquidation: Depending on the characteristics of the bond, a capital gain or reduced capital loss

3. Diminishing bond price volatility: As the bond moves close to maturity, the duration (interest rate sensitivity) of the bond also reduces.

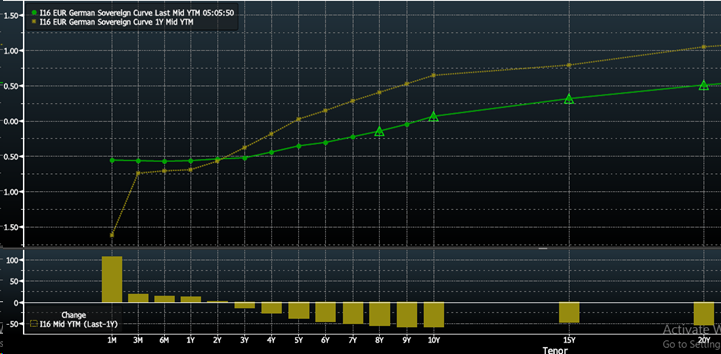

In order to demonstrate how effectively this strategy has played out in the past one year on the German Sovereign curve, we need to discover the steepest section of the yield curve as on 10th March 2018, which we shall roll down from.

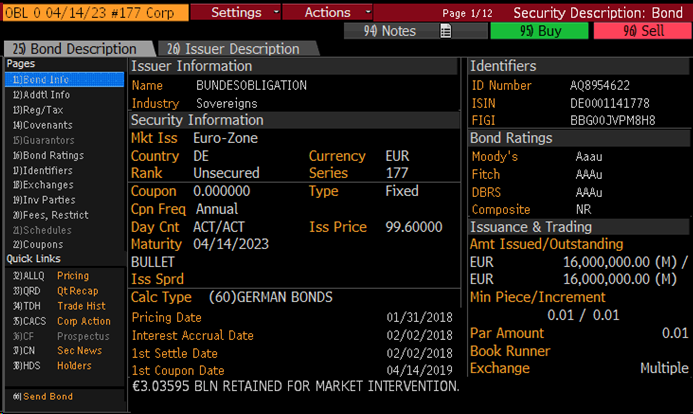

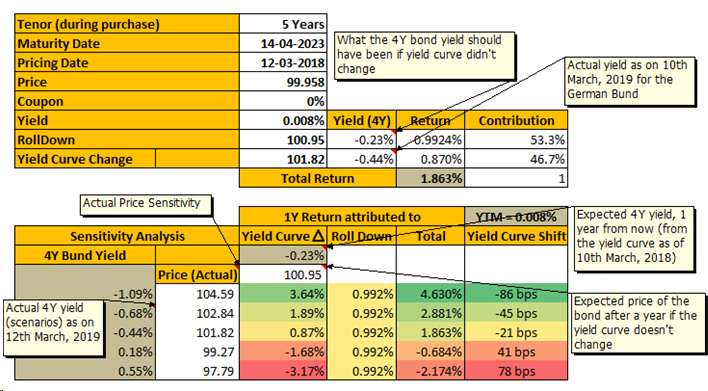

Just from eye-balling, we can deduce that the 5Y Yield at 0.008% and 4Y Yield at -0.23% seems to be steep enough for our strategy. So according to the strategy we buy the 5Y German Bund on 10th March 2018 with a YTM of 0.008% and 0% coupon at a price of €99.958.

In our base case, considering no change in rates across the curve, the yield on this bond should slide towards -0.23% leading to a price appreciation of €0.992 or 0.9924% within a span of one year. However, due to changes in the yield curve, we may incur capital gains/losses. In our case, it is observed that the yield on the new 4Y German Bund has moved down further to -0.44%, leading to a total price appreciation of €1.86 out of which as we calculated earlier €0.992 is attributable to the roll down effect and the rest €0.87 gain is on account of the yields moving down.

Adversely, yields could move higher if global growth picks up and inflation/IIP data delivers a shocker. We can model these scenarios for the next year by estimating the volatility of interest rates and running a sensitivity analysis of our total returns to these yield curve changes. This interest rate risk can then be effectively hedged with Out-of-the-Money (OTM) interest rate options, thus, locking in an effective gain of close to 0.9924% (after deducting the option cost).

As we’ve seen with this example, it is possible to generate positive returns that outperform the broader market by playing with the yield curve dynamics. As they say, it’s all about finding positivity (returns) when you are surrounded by negativity (yields).

Note: This information has been provided by Harsh Shivlani (Department Head, Fixed Income & Derivatives, Finvert) and is for informational purposes only. It is not intended to provide legal, accounting; tax, investment, financial or other advice and such information should not be relied upon for providing such advice.

Crowdfunding is an online extension of financing from friends and family, communities to fund members with some business ideas. The web-technology base used during the projects and the conviction of ideas allows determining which project should receive funding and how much funding should be received. Moreover, providing management and technical assistance with real-time feedbacks on businesses. Crowdfunding makes the entrepreneurs accountable and with the over-bust of social media they’re marketing their ideas and raising funds thereon. A movement which has started to move beyond the transcending boundaries, cultures and political barriers giving fuel to entrepreneurial finance.

Crowdfunding has a long history embedded. Books have been crowd-funded for centuries as authors and publishers would advertise their books with the help of subscription scheme or praenumeration. The decision to publish a book would depend upon the readiness of the subscribers, the power of confidence among investors signaled the nascent stage for crowdsourcing. The concept of crowd-funding has been derived from crowdsourcing which describes the process of outsourcing tasks for ideas, feedbacks, asset, knowledge, resources, and expertise to develop and accomplish the purpose.

During a podcast by Wharton’s Valentina Assenova, he discusses the first noteworthy instance of crowd-funding that gained popularity. When government sources failed to provide funding for the construction of the Statue of Liberty, a newspaper led-campaign attracted small donations from 160,00,000 donors. In 2006, the “Free Blender” campaign which was an early software crowdfunding precursor aimed for open-sourcing by collecting $100,000 from the community while offering additional benefits led to the emergence of the concept.

A report by worldwide expert administrations firm PwC perceives the accompanying classifications: Seed crowdfunding which is the utilization of “rewards-based” crowdfunding. This subsidizes the creations where patrons pay forthright for an item or venture. Value crowdfunding enables little and vast financial specialists to buy little packages of offers. This gets a great deal of press consideration – yet makes up just a little level of in general crowdfunding. Donation-based crowdfunding which is used to assist in networking activities.

“Crowdfunding is a democratized funding”

– Jonah Berger

Regardless of whether it is crowd-sourcing or crowd-funding platforms, both have commission-based plans of action benefiting (commonly 4 – 7.5%) from each effectively supported battle on their stage. Crowd-funding platforms have the additionally preferred standpoint with the capacity to take a value stake in effectively subsidized organizations. However, by and large, the entire plan of action for group-based venture stages is driven by exchange volume. The entire group subsidizing industry, which is in quick development mode at the present minute, is entering a period of the combination. The fragile stages that can’t drive the essential volume through their stages are leaving the business, whereas the grounded stages are extending their market nearness and developing their task-based. Continuing in the matter of crowdfunding the stages need to pursue the model or exit.

In a country like India innovation, creativity and invention arguably have no funding available on its side especially if the reach of technology is limited. Further, the lack of transparency and accountability with the use of funds for a purely creative project impedes the sustenance. The other problem is the number of funds required. It is here that crowd-funding comes to the rescue. Helping these unconventional innovators and entrepreneurs bridge this gap in India is Wishberry.in, a Kickstarter-inspired crowd-funding platform.

Another astounding model is Exploride, Asia’s largest crowd-funding project in Kerela that has set a record in the group subsidizing history of Asian startups. The organization’s Indiegogo battle crossed the underlying target of $100k in only five days and has achieved an incredible $500k mark in 40 days of its dispatch. Exploride’s campaign has been upheld by 1,800 individuals from more than 50 nations over the globe with the greatest number of pledges originating from the USA.

With all the development of the diverse stages and tasks, SEBI discharged a research paper in the year 2014 in regards to the proposition giving proper structures to raising of assets by new businesses and SMEs. Crowdfunding could expel obstacles and made the move from conventional account to present day financing. In 2016 SEBI issued a public statement titled “SEBI Cautions Investors” which secured issues relating to the financial exchange and with more than 200 investor’s, the stage can begin going about as a trade. The delaying of the legalization of equity-crowdfunding as every investor expects a return on investment and framing a proper grievance redressal system is paramount.

The power of crowd-funding applies to projects relating to any field, any amount or any location. Crowd-funding is a viable option and a constant proposed regulation accepted by the Government making it an appealing and desirable option. Looking at the global emergence of crowd-funding there are many pros and cons associated with it. Taking the right steps to encourage crowd-funding will be a boon to many, the different types of models and power of communication make it even easier for start-ups and SME’s to raise finance. The need of the hour is to identify its abundant potential and tap it in this nascent stage.

The name Alternative Investment suggests investments which aren’t traditional by nature and it differs not only in types of asset classes but also the structure of the investment vehicle. On comparing Alternative Investments with Traditional Investments, we can notice that –

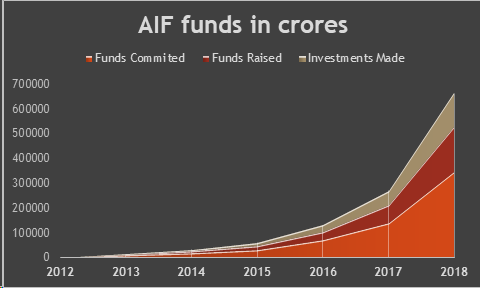

But in spite of the above stated issues, Alternative Investments Funds (AIF), a part of Alternative Investments is on the rise in India. Alternative Investment Funds refers to privately pooled investment funds, either from Indian or foreign sources. AIFs were allowed by SEBI in 2012, and by end of 2013, there were 84 registered AIFs in India.

When we look at the year 2013, India was ranked 9th by the Global Limited Partner Survey of ‘Emerging Markets Private Equity Association’ for the ‘most preferred destination’ by global investors. Fast forward to 2017, India has been ranked numero uno in the same category. This upward climb on the ladder can be attributed to the rise of AIFs in India from 84 registered AIFs in 2013 to 517 in 2019, more than a six-fold increase.

According to SEBI, AIFs are classified in 3 broad categories –

AIFs offer High Net worth Investors (HNIs) and Institutional Investors diversified portfolios which are not offered by the traditional investment options. Over the period of last 7 years the funds raised and invested by AIFs have been increasing year on year. This in turn shows the growth of the Indian economy landscape. India being a developing country the scope of investment in vast and the government is trying to make India not only business friendly but also investor friendly which further increases the scope for AIFs. AIFs invest in startups, SMEs, infrastructure, real estate etc. using mutual funds strategies and by not taking long or a short position which helps in direct capital infusion.

Over the years the Indian government has taken various steps in favor of AIFs such as –

From the above graph we can see the gradual but a steady rise not only in the funds raised but also in the investments made by AIFs. India being a young nation with a lot of untapped capital and has tremendous growth prospects in the future and with such funds on a rise will not only help to reduce the investment deficit of the country but also harness her growth potential.

AIFs being diverse are able to meet the financial needs to HNIs wherein they can choose between short term i.e. liquid funds and long term i.e. physical assets or longer duration funds. AIFs has low returns correlation with the traditional investment products in longer period and aren’t as volatile as stock and bond markets which helps to reduce the portfolio risk.

Although AIFs market is rapidly growing in India it is still paltry in comparison to the global AIF market. The regulators and Government have taken various steps in favor of AIFs there is still a long way to go from here. But the future does look bright.

INTRODUCTION

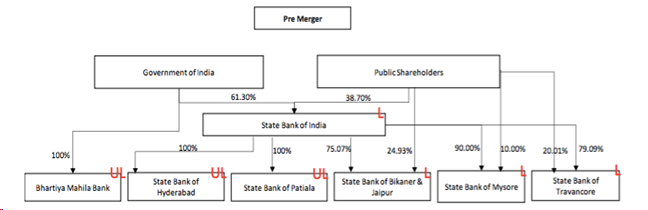

Public Sector Banks (PSBs) are banks where a government holds a majority stake i.e. more than 50%. Currently, there are 27 public sector banks in India. Out of these, 21 banks are nationalized and 6 banks are of State Bank Group (SBI and its 5 Associates) and the shares of these are listed on the stock exchanges. In India, out of the total banking industry, the Public sector banks constitute 72.9% share while private players cover the rest. However, PSBs seem to be losing their market share on account of the huge Non-Performing Assets. Banking industry is undergoing unprecedented changes driven by consolidation by means of mergers and acquisitions all over the world. In recent years, banking industry of India has witnessed a transformation as it was working in highly regulated environment before.

OBJECTIVE

The objectives of the study are:

ANALYSIS

VALUATION OF BANK

As on March 31, 2017, the firm was undervalued even after the merger and increase in share prices. The rise in the share price was not huge and keeping the stock of SBI as undervalued.

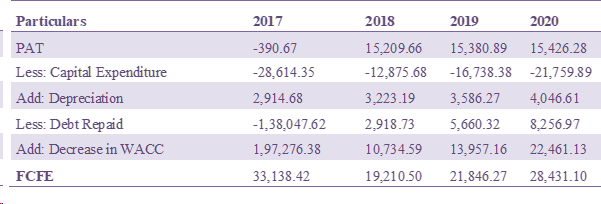

We have use FCFE method in calculation the value of Firm.

Assumptions-

Free Cash Flow To Equity= Profit After Tax – Capital Expenditure – Increase in working Capital + Debt Raised – Debt Repaid + Non Cash Expense

Before merger to calculate FCFE the sum of SBI with all the associates and BMB have been taken before merger so as to reduce the impact of errors.

Capital Asset Pricing Model (CAPM)

CAPM= Risk free Rate of Return +Beta (Market Return – Risk free Rate of Return)

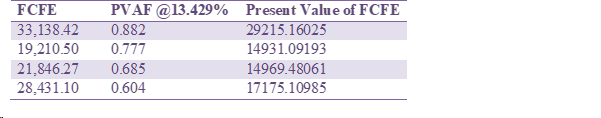

Here, we have take 10 years monthly average of the Government of India Bond return for % years, which comes out to be 7.91%. (Annexure 1)Sensex average monthly return for 5 years comes out to be 11.889% (Annexure 1) and Beta of SBI is 1.3871 (Capitaline)

CAPM= 7.91%+ 1.3871 (11.889%-7.91%)

=13.429%

It is assumed that CAPM is the Present Value Factor and cost of equity of the firm.

DISCOUNTING OF FCFE

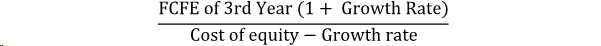

TERMINAL VALUE

Terminal value =

= 345049.4575

PV of Terminal Value = 345049.4575 X 0.60= 208442.968

Value of Firm = 284733.8107

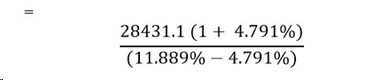

MARKET VALUE

For market value of the firm we have taken the data as on March 31, 2017, the closing price of SBI and the number of total outstanding shares on that date.

UNDERVALUED

Value of firm – Market value = 284733.8107 – 233862.8853

= 50870.9254

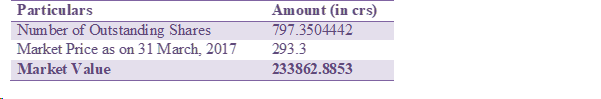

SWAP RATIO CALCULATION

The company came out with Swap Ratio by analyzing three-weighted method in finding out the true value of its associates and making it a fair deal.

Three methods, which are, used are-

The valuation of the company is done on the market value of firm as on 17 March 2017. The company came out with the Exchange rate of 2.8:1 for SBBJ, 2.2:1 in case of SBM and SBT. There was no Swap ratio for SBP and SBH as they were fully owned subsidiary of SBI and 4,42, 31,510 shares for every 100 crores shares of BMB.

CHANGES AFTER THE MERGER

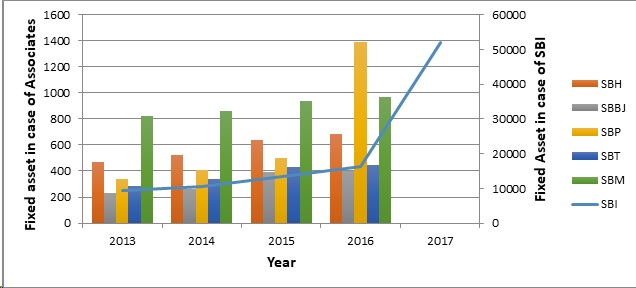

Fixed Assets

The fixed assets of SBI went up to Rs. 51,884.15 crores post the merger from Rs.16,200.90 crores pre-merger as all the fixed assets of the associate banks merged with that of SBI converting it into a larger public-sector undertaking in terms of assets. The major increase in fixed assets was because of increase in Premises of SBI from Rs. 6,505.14 crores to Rs. 42,107.57 crores. After the merger, SBI joined the club of top 50 banks globally in terms of size of assets. The number of branches increased to around 24,017 and ATMs managed by SBI was nearly 59,263 across the country. This will increase the area managed and covered by the bank directly rather through its associates with a wide range of products at lower costs.

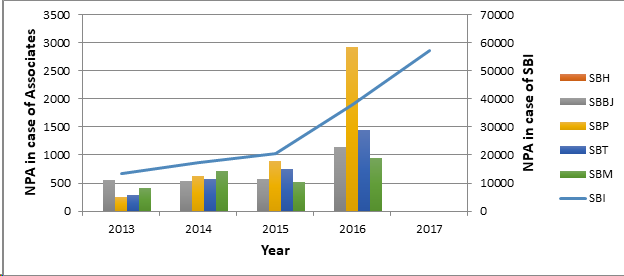

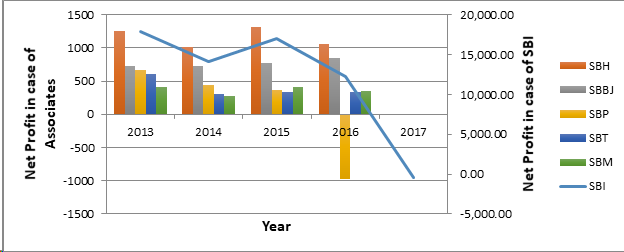

Net Profit and NPA’s

The net profit of SBI pre-merger was reported to be around Rs. 12,743.39 crores which was converted to a net loss of Rs. 390.67 crores post the merger due to integration of non-performing assets of SBI with all its associate banks. The NPA’s were reported to be at Rs. 57,155.07 crores compared to Rs. 38,024.06 before the merger. NPA’s of SBI increased by almost Rs. 19,131 crores which resulted in a great loss to SBI.

Out of all the associate banks, SBP had the largest amount of NPA’s of Rs. 2,924.03 crores and a net loss of Rs. 972.4 crores before the merger. While SBH reported the highest net profit of Rs. 1,064.92 crores with negligible NPA’s among all the associate banks. However, the loss incurred is of short-term nature and gradually with time, SBI will again start reporting profits as a result of economies of scale and reduction in costs of doing business.

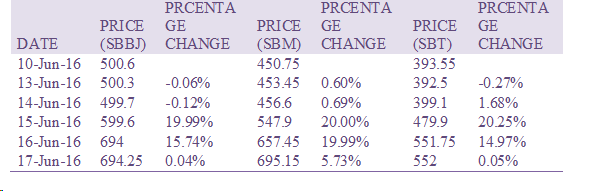

VOLATILITY IN SHARES

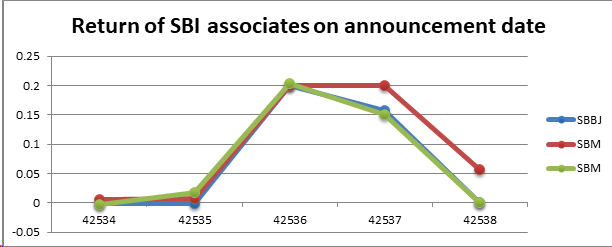

On the date of the merger, markets were bullish on SBI and its associate as SBBJ shares price rose by 20% for two consecutive days hitting the circuit on both days. SBM’s share prices also rose by 20% after the announcement of merger following a growth of 15.74% on the next day. In fact, SBT’s share too rose by 20% after the announcement of merger and further by 15% on the following day. SBI owns a market share of 23.07% in deposits and 21.16% in advances as opposed to 18.05% and 17.02% in deposits and advances respectively.

The combined bank now caters to around 42 crore customers. There exists a large scale of inefficiency among smaller banks which when merged into a larger bank would make it more efficient in carrying its operations.

POST MERGER

Post-merger, the total customer base of the bank has reached 37 crores with a branch network of around 24,000 and nearly 59,000 ATMs across the country. The employees’ strength of SBI has increased to a total of 2,71,765. All the customers and employees of SBI associate banks have become the customers and employees of SBI. So, all the employees are now eligible for the same retirement benefits as the SBI employees. That means, the SBI employees get three retirement benefits i.e. provident fund, gratuity and pension and the associate bank staff members get two retirement benefits.

The merged SBI Bank now has a deposit base of more than Rs 26 lakh-crore and advances level of Rs 18.50 lakh crore. The board of SBI approved the merger plan under which SBBJ shareholders would get 28 shares of SBI for every 10 shares held. For both, SBM and SBT shareholders would get 22 shares of SBI for every 10 shares. However, separate schemes of acquisition for State Bank of Patiala and State Bank of Hyderabad were approved by SBI. Since they are wholly owned by the SBI, there will not be any share swap or cash outgo and for BMB, SBI’s 4,42, 31,510 shares for every 100 crores shares of BMB

No matter what individuals are doing they like to be in control of the situation, they like to know what is the risk associated with it, and also is it worth taking the risk for the benefits that come with it. Any rational person will not make any investments/choices irrationally, one of the most important things investors consider while deploying money in any security is checking the ‘Beta’ of that particular stock. So what exactly is Beta, and is it really that important?

The beta (β) of an investment security (i.e. a stock) is a measurement of its volatility of returns relative to the entire market. Beta is a measure of risk and it allow people to be in control or at least makes them believe so.

Breaking Down Beta

The volatility of the stock by x percent when the market moves by 1% is the beta of the stock. A stock with a high beta will have higher volatility and vis-à-vis a stock with lower beta will have a lower volatility. Beta is a good measurement of systemic risk in the market. Systemic risk is the risk that can be not controlled by the company issuing the security. The General measure for Beta is 1.

Calculating Beta

Beta as I mentioned shows the returns that the security will give when compared to the market. So running a regression on co-variance of daily returns of the security with respect to the markets divided by variance of daily market returns. You can easily do it by shooting up your computer, going to Yahoo/ Google Finance and finding the daily price table of the stock and the market and then putting it in an excel and using the formulas of covariance and variance.

Applications of BETA

With all the good things that come with Beta, it cannot go without getting some criticism. In many cases it is seen that the security does not behave as it is supposed to behave in normal market conditions, hence making the use of beta more reliable or rather useless. Beta only captures the systemic risk of the company, the risk within the country cannot be measured using Beta. Also when the beta is calculated it is the raw beta for the company.

Raw Beta can be known as the historic beta of the company. This beta cannot be in line with the market beta because the company may be comparatively new and may not be diversified enough to absorb the shocks in the market. While calculating the beta on a Bloomberg terminal, the terminal also showcases an adjusted beta. This beta is the estimate of security’s beta in the future.

Adjusted Beta = 0.67* Raw Beta + 0.33* 1

It is believed that in long run the beta for any company will be near to 1, because the company may diversify and absorb more shocks from the market. Therefore after assigning 1/3 of weight to 1 and 2/3 of weight to the raw beta we arrive at the adjusted beta. This method is given by Bloomberg, however there is no justification given by them in regards of weight allocation to adjusted and raw beta.

There is one more complication whilst calculating the beta. Beta can be calculated using monthly, weekly, daily or quarterly returns and also can be regressed against the index of our choice. There is no uniformity being followed as to which set of pair is to be followed as there are several permutations and combinations available. Bloomberg reports a standard beta for 2 year weekly data and for a US company it is regressed against the S&P 500 index, this is because S&P 500 is a broad index.

However, the logic is forgotten when reporting beta for an Indian company. Indian stock is regressed against BSE SENSEX, which is the index for securities with top 30 market capitalization in the country. This is done just because SENSEX has more correlation to the S&P 500. The best way to calculate the beta is to calculate it yourself with the combination of time frame and index which will be right for your calculations.