In Finvert’s first official podcast, Isha Khuteta – a member of Alternative Investments is joined by Mr. Ashish Rane – Senior Manager and team lead of Valuations and Advisory vertical at Aranca, a Global Research and Analytics Firm. Ashish has over 9 years of industry experience, wherein he has worked with the biggest names in the industry. Together, they discuss the valuation of technology companies and to what extent is it justified. During the discussion, Ashish gives us some insights into what factors need to be considered while valuing a technology firm and much more.

Who is liable for cyber fraud?

(M.Sc. Economics, NMIMS – Mumbai 2018-20)

Connect with Areesha

on LinkedIn

REITs – Real Estate Investment Trusts

The increasing incomes, urbanization and economic growth are majorly pushing the residential and commercial realty demand in India. The market size of the Indian Real Estate sector is expected to reach US$ 1 trillion by 2030 from US$ 120 billion in 2017 and by 2025 contribute 13% of the country’s GDP. Currently, the Real Estate sector contributes 6.3% to India’s GDP. This sector is growing at a rate of 10% p.a. From the past records, the returns from real estate investment have rarely been negative largely due to capital appreciation. It has also become a preferred class of assets for investments. But looking at the current property rates, buying a property is no piece of cake.

So how do people benefit from real estate without actually buying a property?

To overcome this hurdle, REIT’s were introduced.

WHAT IS A REIT ?

Real Estate Investment Trusts or REITs are companies that own or finance income-producing real estate in a variety of property sectors.

A REIT is a security linked to real estate that can be traded on the stock exchanges. They are similar to mutual funds. Just like mutual funds, REITs also have sponsors, trustees, fund managers, etc. Both can be bought in units. However, like mutual funds have their underlying securities like stocks, bonds, gold, etc. REITs invest in income-producing real estate. REIT is basically investing in real estate without actually buying the property. The amount raised from the listing is invested in income-producing real estate like commercial office spaces, warehouses, malls, hotels, etc. The profits from these properties are then distributed amongst the investors. At least 90% of the taxable income should be distributed by a company to qualify as a REIT.

GLOBAL SCENARIO

The US based REIT approach to real estate investment offering investors access to portfolios of income-producing real estate has been adopted by nearly 40 countries worldwide. Mutual funds and ETF’s offer the easiest and most efficient way for investors to add global listed real estate allocations to their portfolios.

Following is the comparison of the S&P US REIT Index with the S&P 500, indicating the trends over the years.

Launched on December 31 1992, the S&P United States REIT Index defines and measures the investable universe of publicly traded real estate investment trusts listed in the United States.

We can see that over the last 10 years, the returns from these indices have been similar. However, looking at the 1 year annualized returns the REITs index has largely outperformed the S&P 500 with returns of 16.24% compared to the benchmark returns of just 5.87%.

REITS IN INDIA

REITs have been introduced for more than a decade in India, but it was only in October 2013 that a draft guideline was issued by the Securities and Exchange Board of India (SEBI). However, discrepancies regarding the tax implications on the income earned and some other related aspects were restricting the instrument from becoming a reality. Though to overcome the issues there was some movement in the 2015 Budget, lack of clarity on a few things did exist.

The procedure for a REIT to get listed on the exchange is quite similar to getting a company listed. Necessary documents have to be submitted to SEBI, a red herring prospectus is issued, registrar and book running lead managers are appointed, and then the IPO is open for subscription.

Country’s first listed Real Estate Investment Trust – Embassy Office Parks REIT opened for investment between March 18 and 20, 2019. The company had planned to raise Rs. 4570 crore through the IPO. With a minimum application of 800 units and 400 units thereafter, the per unit price of the instrument was kept at 299-300, making it an investment of Rs. 2.4 lakhs. In the first month of its listing since April 1, it has managed to outperform the benchmark equity indices. This instrument delivered a return of 7.32% against the issue price of 300, whereas the NIFTY had gained a mere 1% in that period. One interesting fact about this IPO is that there were more than 10 book running lead managers, including top investment banks like Goldman Sachs, J.P Morgan, Morgan Stanley, Axis Capital and more.

To make REIT’s more attractive several amendments have been made in the past few years. As per the latest amendment by SEBI on 1st March 2019, the minimum investment limit has been reduced to ₹50,000 from ₹2 lakh. The minimum investment in the Embassy Office Parks REIT IPO is above ₹2 lakh as it was filed much before the amendment was made.

SCOPE FOR REITS IN FUTURE

REITs in India are at a nascent stage. Seeing huge growth potential in the Indian economy, global investors are making huge investments to acquire large commercial office spaces to increase their REIT portfolios and thus this increases the scope for REIT’s as more and more commercial space would be needed to fulfill these demands. Also, the projected five-year returns on commercial assets are expected to be around 12-14%, hence good returns can be expected from REIT’s.

A recent report by JLL India had projected $35 Billion worth of office stock, that the commercial real estate market is likely to provide, around 294 million sq. ft of space that can be listed under REIT’s.

In the past few years, the government’s move to bring progressive alterations in India’s REIT policy has been a major cause for the increasing interest of investors in the commercial office space, making it more market-friendly. Progressive regulations, rising transparency levels and a healthy commercial real estate market in the country have made the segment a favorite amongst institutional and global investors, who have allocated nearly $17 billion in the form of direct investments.

Performance-wise, REITs offer stable cash flow and attractive risk-adjusted returns. Also, a real estate presence can be good for a portfolio, diversifying it with a different asset class that can act as a counterweight to equities or bonds.

Nimil Jain

Volunteer – Equity Research and Valuation

(M.Sc. Finance, NMIMS – Mumbai. Batch 2018-20)

Connect with Nimil on LinkedIn

How Blockchain is changing dynamics for Stock Trading

In the recent past Blockchain has been the most talked about technology, it was originally designed to digitize and decentralize currency (Bitcoin) by using multiple ledger systems. What if there are multiple application of this technology and not just limiting it to the use of currencies. Experts over the world are now validating the use of this technology over the areas such as supply chain management, cross border trades & finance, etc.

Blockchain has gained so much attention and admiration because

- It is decentralized, no single entity owns it

- The data is cryptographically stored inside

- Data tampering cannot be done inside blockchain, it is immutable

- It is transparent

So the question raised is that can blockchain tech be used in stock trading and if yes then how will it change the dynamics of it.

Recently, SEBI has appointed a Committee on Financial Regulatory Technologies (CFRT) , exploring the possibility of using Blockchain platform in areas of post-trade settlement and fundraising. Japan is already the front runner, as it has already implemented blockchain as its core trading infrastructure at Tokyo Stock Exchange. Japanese brokerages have reportedly initiated an consortium, dedicated to adopt the process of blockchain, the founding member were Rakuten Securities, SBI Securities, Daiwa Securities and Nomura.

Back in 2015 Nasdaq, started the use of its Nasdaq Linq Blockchain ledger technology, this allows private non listed companies on the stock exchange to represent their own shares digitally. With the help of Linq and blockchain it is now possible for private companies to successfully complete and record securities transactions.

Intermediaries Minimization

A single trade between buyer and seller involve stockbrokers, depositories, bank, clearing corporation, etc. The intermediaries are for efficient functioning of the markets but they are not indispensable. Consider brokers, most of them require you to keep a minimum deposit to start an account, forget the stock trading fees, then there are other fees like option fees, etc. In a world where DIY is given so much importance such high fees is unjustified. One survey found that 9 out of 10 millennials would prefer free digital trading platform instead of a regular broker. Budget conscious investors who are unwilling or unable to buy entire shares would be happy to use blockchain powered apps which allows micro-investing.

Built in Regulation

October 24th 1929, also known as “Black Thursday”, as 13 million shares were sold in panic by the investors on NYSE. Nearly 90 years later there is no way to shape up financial sector as such incidents have had happened since then (Black Monday, Black Tuesday, etc) Perhaps blockchain will take the regulatory imperative from traders hands for goods. Users of blockchain with the help of a passkey can access the ledger remotely. Traders could save money by permitting the regulators some oversight into blockchain powered trading. National Stock Exchange (India) is also piloting on such a blockchain system for automatic KYC process.

Dividends

Some investors buy shares which gives dividends on regular basis and also who wont like some additional money coming in form of dividends. A significant portion of returns is attributed to dividends. “Cash on hand is music to an investors ears.” Automation in the dividend payment process would help the companies in saving a lot of time and money. Blockchain smart contracts help in creating process of self-executing payments. This payment will release the dividends to the customers on behalf of the companies. TMX Global and Natural Gas Exchange (NGX) are testing automatic dividend payments.

Ease in post trade events/ settlement

Over a million securities in India change hand on daily basis. The size of global investing marketplace cannot be comprehended by humans. Efficient trades settle on T+0 or T+1 day. There is need for automation in the settlement of trades happening. The way to do it maybe is with the help of blockchain powered smart contracts. Smart contracts can replace human oversight which happens in settlements of trades which by the way is also very costly. As soon as some pre-requisite is fulfilled these contracts execute. For eg. If a buyer and a seller agree on a price point the trade will be executed, resulting in shorter time lag. Shorter time lag means more money is available ko keep wheeling and dealing. Nasdaq Linq Blockchain Ledger, Australian Stock Exchange, Deutsche Borse are already using such technology for after trade settlement.

Asset Management and Fund Raising

A lot can be said about a company through its fundraising. Tesla’s management has admitted that it often runs negative cash flow. Even if the public weren’t privy to such an admission, Tesla’s relatively frequent return to the fundraising table would have clued investors in. Elon Musk’s electric car company raised $270 million in capital in 2010, $451 million in 2012, and over $18 billion total between 2010 and 2018. Experts don’t expect Tesla to be cash flow positive for quite some time. But perhaps Musk and the heads of other publicly traded companies who require capital could execute fundraising even more efficiently and cost-effectively by adopting blockchain technology next time. Companies will be able to sell stock directly to public without time constraints. Blockchain’s value comes from its ability to conduct fundraising sales and agreements without any middlemen involved. It dispatches cost-effective and immediate smart contracts to execute the transactions, saving money and time without sacrificing quality. aXpire is a blockchain powered company trying to solve this problem.

Tracking Securities Lending

Security lending is not understood by a mass of population. Traders lend ETFs or a commodity within ETF to other parties in exchange of a collateral. Nearly 3.5 trillion USD worth of ETF as of December 2018 was the market share. ETFs are considered as safe return instruments but are not so safe after all, using technology to hedge the ETFs could be critical as the market worsens. Leveraged loans that led to last financial crisis, most of the ETFs are heavily invested in such leveraged loans. For ETF manager lending securities to short seller is low stress and high upside proposition. Tracking the price of ETF is important. They can be tracked through blockchain powered ETFs, and triggers the issuance of collateral if the short seller becomes over-leveraged. Nasdaq Linq Blockchain ledger is tracking the purchase of securities.

Sagar Vikmani

Team Member – Equity Research and Valuation

(M.Sc. Finance, NMIMS – Mumbai. Batch 2018-20)

Connect with Sagar on LinkedIn

Libra – Facebook’s cryptocurrency

Facebook has revealed plans for a new global digital currency, claiming it will enable billions of people around the world without a bank account to make money transfers. The digital currency is called Libra and will allow its billions of users to make financial transactions across the globe, in a move that could potentially shake up the world’s banking system.

Facebook revealed the details of its crypto currency, Libra which will let you buy things or send money to people with nearly zero fees. It released its white paper explaining Libra and the technicalities of its blockchain system before a public launch in the first half of 2020.

The effort announced with 27 partners right now ranging from Master Card to Uber and should launch sometime next year with 100 partners, as it hopes. It is a stable coin backed by a basket of actual currencies and marketable securities. Facebook will only get a single vote in its governance of the crypto currency along with its partners.

The currency will be run by the Libra association as Facebook is distancing itself from the direct management. Facebook’s involvement will be run via a new subsidiary called Calibra that handles its crypto dealings and protects users’ privacy by not mingling an individual’s payments with his/her facebook data. By this an individual’s real identity won’t be tied to his/her publically visible transactions. Calibra will also be launching a digital wallet for Libra, as a standalone IOS, android application and also as a functionality within whatsapp and messenger. Libra is the underlying technology but Calibra is likely how most people will interact with the currency. It will be the first crypto currency wallet that millions of people will have access as it takes advantage of facebook’s massive ecosystem with billions of potential users.

One of the biggest problems that the regulators will have to tackle is drug dealers and money launderers from getting their hands on Libra and using it to move money from the eyes of the law enforcement like with any crypto currency.

“The issue is that once you apply traditional regulation to tokens that are backed by money in the bank then those tokens start to look a lot like normal fiat money, after all most money we use today – credit card, apple pay, PayPal etc is just the digital representation of money that the banks promise to ultimately backup. This is the exact same thing except on a blockchain”- Techcrunch

Libra Whitepaper states that unlike previous blockchains which view the blockchain as a collection of transactions, the Libra blockchain is a single data structure that records the history of transactions and states over time. Facebook has created a whole language for writing commands on its protocol called MOVE (programming language), which is an open source prototype in anticipation of a global collaborative effort to advance this new ecosystem. The facebook has done its homework to cherry pick the best bits and pieces of other crypto project to create Libra.

Like bitcoin there is no real identity on the blockchain; from the perspective of the block chain itself you don’t exist, only public private key pairs exist. Like hyperledger it’s permissioned (at least to start); initially the consensus structure of Libra will be dozens of organisation that will run nodes on the network, validating transactions. Like tezos it comes with on-chain governance; the only entities that can vote at the outset are founding members. Like ethereum, it makes currency programmable and in a number of ways the whitepaper defines interesting ways in which its users can interact with the core software and data structure. For example anyone can make a non-voting replica of the blockchain or run various read comments associated with objects such as smart contracts or a set of wallets defined on Libra. Crucially, Libra’s designers seem to agree with ethereum that running code should have a cause so as to all operations require payment of Libra as gas for it to run. Also like ethereum, it thinks proof of stake is the future but it is also not ready yet. Like binance’s coin it does a lot of burning. Like coda, users don’t need to hold on to the whole transaction history – states Coindesk.

Now needless to say, this is pulling a lot from the latest and greatest crypto ideas and collaborating it.

Facebook launched 2 crypto currencies, addition to Libra the project will also have a Libra investment token, which is how the stake holders (100 or so partners facebook hopes to have lined up on launch) will make money on this, as Libra itself is not supposed to fluctuate in value.

Unlike Libra a currency that will be broadly available to the public, the investment token is a security according to facebook that will be sold to a much more exclusive audience – the funding corporate members of the projects governing consortium known as the Libra association and accredited investors. While Libra will be backed by a basket of fiat currencies and government securities, interest earned on that collateral will go to holders of the investment token. As previously reported ahead of the official announcement, each of the 27 companies that facebook recruited to run validating nodes as founding members of the consortium, invested at least 10 million dollars for the privilege. The investment token is what they received as a financial reward, but that reward will only be meaningful if the network takes off – states Coindesk.

The assets in the reserve are low risk and low yield for early investors which will only materialise if the network is successful and the reserve grows to a substantial size, facebook said in one of the series of documents that supplement the Libra white paper.

This sound a lot like how an Initial Coin Offering – (ICO) has worked over the past of years, except without the expectation of price appreciation as the reward to early investors.

We will have plenty of time and a lot of information to dig into in the coming months, but my bottom line and initial take is that the money we have today has not worked very well for all of us, furthering the gap between the rich and the poor. Libra (crypto currency) has the potential to bridge this gap but it has to bypass too many regulatory complications.

If facebook succeeds and receives cash for Libra, it and the other founding members of the Libra association could earn big dividends on the interest. If Libra gets hacked or proves unreliable lots of people around the world could lose their personal information and money. But it is clear that facebook has tried to reinvent money, we will have to wait and see if they can pull it off.

Indrajith Aditya

Team Member – Equity Research and Valuation

(M.Sc. Finance, NMIMS – Mumbai 2018-20)

Connect with Indrajith on LinkedIn

Non-Performing Assets (NPA) of India: Journey so far and the road ahead!

“The failure of a loan usually represents miscalculations on both sides of the transaction or distortions in the lending process itself.”

— Radelet, Sachs, Cooper and Bosworth (1998)

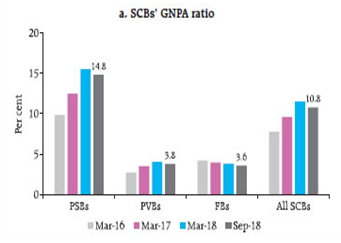

In the recent times the newspapers have been filled with some or the other news, issues, policies, regulation or resolution of NPAs. The NPA ratio has come down to 9.3% in March, 2019 from 11.5% in March,2018 according to mention by RBI Governor Shaktikanda Das.

According to RBI, the definition of NPA is: ‘An asset, including a leased asset, becomes non-performing when it ceases to generate income for the bank.’

A non-performing asset (NPA) is a loan or an advance where the payment of principal/interest is due (in default) for 90 days or above.First, when there is a default of payment, till 90 days, the accounts are subsequently classified as Special Mention Accounts (SMA): SMA 0/1/2. Then after 90 days, these accounts are classified as NPAs.Further NPAs are classified into substandard,doubtful and loss assets.Any income for standard assets is recognized on accrual basis, but income from NPAs is recognized only when it is actually received.

Reasons for accumulation of NPAs:

Increasing cases of wilful defaults and frauds are often considered as the primary reason behind the accumulation of bad loans in the Indian banking system.

When an economy experiences healthy GDP growth, a substantial part of it is financed by the credit supplied by the banking system. As long as the GDP keeps growing, the repayment schedule does not get substantially affected. However, when the GDP growth slows down, the bad loans tend to increase due to macroeconomic factors, primarily among them are interest rate, inflation, unemployment and change in the exchange rates.Hence, bad loans accumulate as borrowers are unable to repay due to stalling/closure of the big development projects

Bank-related micro indicators such as capital adequacy, size of the bank, the history of NPA and return on financial assets also contribute to the accumulation of bad loans. NPAs, specifically in the Public Sector Banks (PSBs), have adverse effects on credit disbursement. Increasing amounts of bad loans prompt the banks to be extra cautious. This in turn has caused drying up of the credit channel to the economy, particularly industries, making economic revival more difficult.

Need for Solution

Reviving industrial credit is crucial for the health of the overall economy, because industry (particularly manufacturing) tends to create more employment.

Mounting bad loans suggests vulnerability in the system, wherein short-term deposit-taking banks have to extend credit for long-term big development projects. And this model is visibly failing. Hence NPAs put several small depositors of the banks, particularly in the PSB, at risk.

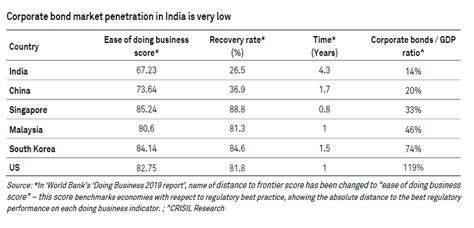

Also an improvement in the recovery rate and reduction in timeline for resolution for insolvent companies will increase investor confidence in Indian Bond Market.

Recognition of the problem and the solution:

NPAs story is not new in India and there have been several steps taken by the GOI on legal, financial and policy level reforms. In the year 1991, Narsimham committee recommended many reforms to tackle NPAs.

SICA Act, The Debt Recovery Tribunals (DRTs) – 1993, CIBIL: Credit Information Bureau (India) Limited-2000, LokAdalats – 2001, One-time settlement or OTS- compromise settlement-2001, SARFAESI Act- 2002, Asset Reconstruction Company (ARC), Corporate Debt Restructuring – 2008, 5:25 rule – 2014, Joint Lenders Forum – 2014, Mission Indradhanush – 2015, Strategic debt restructuring (SDR) – 2015, Asset Quality Review- 2015, Sustainable structuring of stressed assets (S4A)- 2016 were some of the techniques applied to tackle the problem by government and RBI.

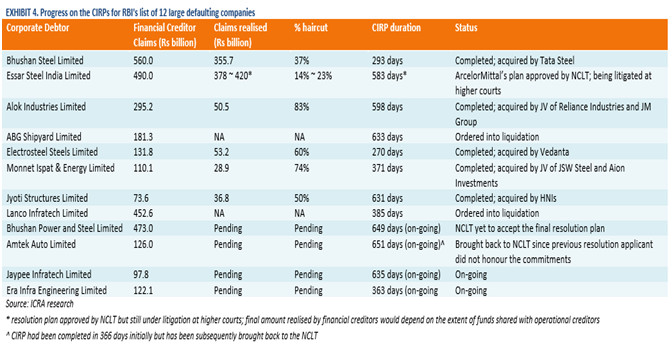

Every method was entangled, rules were not that clear, there were lot of cases pending in front of DRTs owing to limited infrastructure, not enough field experts and hence, it took years for creditors to recover their money. India needed a structured process; thereby Insolvency and Bankruptcy Code (IBC) -2016 came into existence.

It sets a time limit of 180 days which can be extended by another 90 days to complete the entire process. Some of the features of the code include the allocation of a new forum to carryout insolvency proceedings, setting up a dedicated regulator, creating a new class of insolvency professionals and another new class of information utility providers.

The forum where corporate insolvency proceedings can be initiated is the National Company Law Tribunal (NCLT) and appeals against its decisions can be made in the (National company Law Appellate Tribunal) NCLAT. The IBC vests the NCLT with all the powers of the DRT.

Insolvency professionals will have the task of monitoring and managing the business so that neither the creditors nor the debtor need worry about economic value being eroded by the other.On acceptance of the application by NCLT for proceeding for Corporate Insolvency Resolution Process (CIRP), Board of Directors of the company has to step down and Insolvency Professional takes the charge and the plan for revival or liquidation of the company, approved by majority of creditors is put in the action according to the IBC rules and timeframe.

It is predicted that the NCLT is focused on the legal process while the insolvency professional is focused on business matters.RBI listed out the 12 major accounts in India, which has the largest share of NPAs in the country.

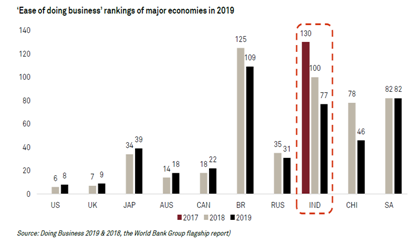

Some great results have fared in: Ranking for ‘Resolving Insolvency’ But still there is a long way to go: Suggestions

As mentioned above, there is a mismatch of assets and liability for the banks. Banks’ assets are long term loans, whereas banks liabilities are short term deposits, which have landed banks in failures. Hence, it makes sense to say that commercial banks should be focusing on short term assets to match their short term liabilities. And for Long term projects, special purpose vehicles (SPV) should be created to fund a particular sector project and financial institution should be created to fund these SPVs and should be given incentives and proper regulation from the government.

Also, as recapitalization of PSBs is going on, a bank should first divide its assets into good and bad, meaning viable and unviable asset. Banks should be recapitalized according to viable assets to revive with its positive core rather than just giving out public money. By this, banks can also focus on their core business rather than managing NPAs and not contribute to slowing of the economic growth.

SICA Act in India was a ‘Debtor in Possession’ (DIP) Model just like U.S. Chapter 11. But there were flaws in the act compared to the U.S.model. There was also a problem in the assessment of viability of the company as only a few accounts were revived. ‘Another relevant fact is the definition of insolvency or ‘sickness’ under the SICA. The N.L. Mitra committee criticized the definition provided by SICA i.e. ‘at the end of any financial year, accumulated losses equal or exceed its entire net worth’ stating that this is the end rather than the initial point where the company’s problems begin.’

Time has changed, India made a comeback with ‘Creditor in Possession’ (CIP) Model of IBC inspired by U.K. owing to similarities in the judicial process and SMEs culture, but there is one problem. In SICA, debtors were made liable to take the proceeding to court if it is identified by them that company is in trouble. Under IBC there is no such amendment and hence there is a ‘problem of initiation’ which was clearly seen in the case of Jet Airways. Just because directors didn’t want to step down, they dragged the process, rejected lot of revival bids in early insolvency phase. And be it any reason, even the financial or operational creditor did not initiate the process.

Australia also followed CIP model, but faced the same problem and added the amendment to make directors liable for any default under their directorship, directors became scared to default and didn’t take any risky decision to grow the company making them stagnant. This also should not happen with India. But then Australia laid ‘Safe Harbor’ provision to ease out the rules. Hence still amendment in the IBC is required to make directors take help from outside professional for the revival of their company in the early insolvency stage itself.

On June 7,2019, RBI laid provision pertaining to rules for creditors to enter into a ‘review period’ in the first 30 days of default by the debtor account, and make a resolution plan for the concerned account and apply the plan in next 180 days to revive it. If the plan is not put into implementation, provision for this account is required to be increased more and more as days pass. This might lead the banks to initiate the CIRP of the account under IBC and may overcome the ‘Initiation Problem’ from the side of creditors. According to this new frame work for stressed assets, the above mentioned rule is now applicable to Small Finance Banks and NBFCs, as they have become an integral part of the economy and needs to be properly regulated to retain the trust of investors.

There can be a solution to mitigate the problem of NPA by forming a‘Bad bank’. But this is a very risky model as it requires extensive research and cross-country analysis as the taxpayers’ money is on table.

In India Secondary Market for Corporate Loans, particularly distressed loan is in the making, taking inspiration from U.S. and European market. But there is a problem of transfer pricing of these distressed assets. India will have to design a proper mechanism, a platform and regulation of valuation techniques using DCF method, so that there isn’t much of a gap between the bid and the ask price of the assets and so the market remains active and transparent.

India and the banking system requires a major turn around and all the financial professional will have to put in the work.

Vishwa Parekh

Volunteer – Fixed Income & Risk Management

(M.Sc. Finance, NMIMS – Mumbai. Batch 2018-20)

Connect with Vishwa on LinkedIn

How Does The 2019 General Election Results Alter The Market Dynamics For India?

The stock market indices and the share price of the companies listed on these indices constantly keeps changing due to company related factors and market-related factors. The company related factors are usually its annual performance in terms of revenue generated, market size captured, innovative product/service offered, capturing various synergies that derive its value on the index, etc. The key elements that drive the market-related factors are the macro events that take place which dictates the direction in which a particular company or the whole industry tends to move towards.

The prominent macro events such as inflation, monsoon, trade policies, financial factors, trade war, oil prices, global markets etc. are a few to name. But, one of the most crucial factors is the government that is ruling the country as it’s the epicentre of all the policies, reforms, schemes and decisions made in the country which acts as an indicator of the road which is ahead to come. Hence the importance of the motto and ambition of the incoming government is so crucial. However, the market overall will tend to thrive in the long-run irrespective as to which government comes into power.

As seen in the table below are the annual returns derived by the BSE index over the tenor of the ruling government. Here, it’s clearly visible that the returns derived from the market index have more to it than the party ruling the government.

The markets always hope for a stable government at the Centre so as to have consistency and stability in the economy as the government is the sole authority of framing the prominent economic policies of India. The foreign players generally prefer to invest in economies that have a stable government with strong policies with long-term visibility. The Indian equities have witnessed foreign inflows worth a net of $6.7 billion from January to March, which is more than the outflows of $4.4 billion in 2018. This optimism has kept foreign investors bullish on India and the market is benefitting from huge emerging market inflows.

India is set to emerge as a USD 5 trillion economy over a period of five years and as a USD 10 trillion economy eight years after that. This gives a clear indication of the growth prospects and the sectors in which the opportunities will arise on these lines. In terms of fundamentals of the country’s economy, its inflation has come down from over 10% five years ago to about 4.6%, the fiscal deficit has come down from almost 6% to 3% which are very important indicators. We have already grown in the last five years from being the 11th largest economy in the world to the sixth. This has led to ease in the monetary policy (which we already have started to witness) which in turn can boost consumption.

To attain this kind of scales, the country needs inclusive and sustainable growth. And for this, the focus needs to be on physical and social infrastructure. The government has been taking a number of initiatives to address and correct the imbalances in both the economic growth and development of the country. BJP’s election manifesto this time around was focused on infrastructural development which has already started to witness growth from the ground level during their last tenor.

The government is expected to make a capital investment of Rs 100 lakh crore by 2024 in the infrastructure sector as well as announce a new industrial policy to improve the competitiveness of manufacturing and services. This has given a more optimistic outlook going forward. Hence, companies of sectors such as Infrastructure, Power, Capital goods, Manufacturing and Construction will witness significant progress and growth over the government’s next tenure. Some sectors such as FMCG, IT, Metals. Pharma keeps growing irrespective of the election cycles.

With the progressive economic steps of implementing Goods & Service Tax, De-monetization, the government looks to roll out further steps to organize and streamline the conduct of businesses and trades. Hence it would advisable to avoid the sectors or companies which have an unorganised structure and a low sustainability business model.

The Modi government’s return to power is likely to propel the agriculture sector stocks as well. New agricultural reforms, policies, financial aids availed to the farmers and the export policies and incentives has improved the quantity and quality of the output which can be used for domestic consumption as well as for exports. This will leave more money in the hands of farmers which will be spent on buying tractors, cars and two-wheelers in the rural market.

The power sector has also witnessed a significant improvement in energy deficit situation over the last four years of the tenure. The country’s energy deficit, which remained in the range of 8% and 10% during 2011-13, has improved in FY14 to 4-4.5%, and subsequently contracted to a mere 0.7%.

With the implementing of Housing for All, Rural Development & Electrification, Smart City Projects, development of roadway and waterway connectivity, and many such policies being already rolled on and many being in the pipeline as well, industries that have been directly linked with these schemes and policies such as construction, building materials and accessories etc. will directly benefit from the same.

Banking sector stocks are also likely to rise since sales in the auto sector, demand for housing loans and agriculture loans will lead to a rise in their loan books. The re-organisation of the increased banking NPA’s has also propelled these stocks towards profitability. Also, banking stocks have been at the forefront of almost all rallies on the benchmark indices.

The Make in India policy and Start-up incentives provided by this government is expected to increase the employment opportunities in this market. With the kind of global recognition India is gaining throughout has been reflected by the way other economies and government is viewing India as an investment destination. This has led to strengthened relations with major member nations giving the country a much greater economic, financial, technological and political horizon to look forward to.

Though many of the investors have a different philosophy and they prefer not to try and time the stock market. They prefer to stay invested for a long time and usually have a diversified portfolio which can smoothen the impact of the immediate volatility of the market. However, analysis of this event helps to not only smoothen the immediate impact of the volatility in the market but also helps to plan the portfolio reshuffling. Thus, understanding the vision and policy-making of the government over the next tenure will help to identify the sectors that will grow in the upcoming tenor and investing in the most efficient business model of the company in that particular sector can give the investors multi-beggar returns.

Dhrumil Wani

Team Leader – Equity Research & Valuation

(M.Sc. Finance, NMIMS – Mumbai. Batch 2018-20)

Connect with Dhrumil on LinkedIn

Gaining the edge: Parallel banking for Indian economy

India is going to emerge as the fourth largest economy in the world by 2025 with a GDP of about $5 trillion. With that, India needs to address financial credit access to its rural population that today constitutes about 66% but having an economic contribution of 15%. To achieve a figure like this, the country needs to create 10 million jobs a year, which can be best achieved by meeting the credit needs of small businesses. Moreover, meeting the gap requirements of infrastructure investments, of over US$ 526 billion over the next 20 years is another challenge. Fact scan, check. Problem Statement, check.

Source – RBI

Now let’s look at what the parallel banking sector has in store for us

A quick google check tells us that it is a term for the collection of non-bank financial intermediaries that provide services similar to traditional commercial banks but outside normal banking regulations. A simple solution. Empower NBFC’s. Check.

It is likely that the next 5-year period will be marked by corporate CAPEX cycle as well as continued Government spending in the Infrastructure sector. Assuming a steady Credit-GDP ratio of 85% and a nominal GDP CAGR of 10-11% suggests that the banking cum NBFC credit can increase by 12-13% CAGR to touch levels of US$ 2.7 trillion by 2025. The question arises, can our present banking infrastructure support this requirement or do we need more vibrant participation by NBFC’s?

Source – RBI

Source – DBEI

In the last few years, the ratio of Manufacturing & Industry – Credit to GDP has consistently fallen from 79% (2013-14) to 72% (2018-19). Indeed, this was the period marked with NPA’s that fettered the bank’s ability to lend to the manufacturing sector. On the other hand, the NBFC’s share of credit-GDP ratio has gone up substantially from 6.5% in FY-08 to 19.1% in FY-18. Participation of NBFC’s has been across the value chain from high-risk and un-collateralised credit to mortgage financing for salaried class.

Clearly, the approach going forward will require a massive expansion of a banking network, re-tooling the NBFC’s for expansion of credit especially to small businesses, creation of a dedicated Rural banks, specialised NBFC’s for diverse assets, and other measures that would stimulate private investment and provide mechanisms to promote project financing and infrastructure development.

In India, we have the situation that banks finance large businesses, medium and small businesses, home mortgages, auto loans, personal loans, and credit cards, each of which have totally diverse risk management requirements. Should we not adopt the model of the developed economies where there are specialised financial institutions for different assets? While we do have housing finance companies, NABARD for Agri-credit, NBFC’s for auto loans etc, the need is to allow a larger number of NBFC’s specialised in the diverse asset class. This enables focused risk management, relevant to the nature of the asset being financed.

Presently, the NBFC’s balance sheets are pre-dominantly funded from the banking sector. NBFC’s access to public deposits is very tightly regulated by the RBI due to issues of the past.

Moreover, the rising importance and the geographic reach of the NBFC’s especially to the small businesses requires a refreshing look on the allowing the NBFC’s to tap the public deposits and making them as cost-effective competitors to the banking sector. The fear of default or misuse of public funds by NBFC’s can be managed by the deployment of technology to manage the risks on a real-time basis.

Another challenge for India is to finance its massive infrastructure requirements estimated at US$1.5tn over the next 20 years (“Around US$4.5trillion worth of investments is required by India till 2040 to develop infrastructure to improve economic growth and community wellbeing. The current trend shows that India can meet around US$ 3.9trillion infrastructure investment out of US$ 4.5trillion. The cumulative figure for India’s infrastructure investment gap would be around US$ 526bilion by 2040.” – Economic Survey 2017-18).

The key issue plaguing the financing of infrastructure is a lack of long-term debt market in India. Perhaps, the time has come to allow a relaxation of the present rating norms for the investment of 5-10% of the corpus of pension funds, insurance funds and provident funds to invest in A-rated infrastructure finance companies.

The banking sector has limited ability to provide project finance, which acts as a barrier to attract private investments in new projects. Perhaps, we need to once again revive the old concept of development financial institutions (DFI’s) that will take the lead in providing project finance. The business model could be that the DFI’s are owned by the Government and international financing institutions – investment funds. The proceeds of bank privatization could partly offset the capitalization requirement of the DFI’s from the Government.

Let us now look at what could be done to the existing banking sector:

In the 1970s and 80’s the nationalization of the banking sector was to support and promote the socialistic economic ideology. Since 1992 India has been on a path of private capitalization and has aborted the socialistic pattern of economic development. This being so, why is our banking sector still Government-owned? We have also evidenced that Governmental control of the banking sector necessarily implies that the banks must fall in line with Government guided lending directives whether they make economic sense or not. The saga of NPA’s and loan waivers proves the above and establishes the basis of Government divestment in the commercial banks. The privatization proceeds so received by the Government should be used to capitalize the launch of rural banks. Ideally, the State Governments should join hands with the Centre – RBI for capitalization of the rural banks.

In conclusion, if in the next 11-12 years India is to emerge as a $7 trillion economy thus being the third largest in the world, and if we are to ensure an economic development percolates to the bottom of the pyramid, we will need banking reforms which lead to:

- Privatization of existing PSU commercial banks

- Expanding the participation of Small Finance Banks, as well as allowing a level playing field for the NBFC’s to raise public deposits

- Establishment of Rural banks with technology support

- Establishment of Development Financial Institution’s to provide project financing support to private and PPP projects

- Creation of a long-term debt market, and

- Commercial banks to focus on doing short to medium term loans and consumer loans.

Anushka Chordia

Team Member– Alternative Investment Funds

(M.Sc. Finance, NMIMS – Mumbai. Batch 2018-20)

Connect with Anushka on LinkedIn

Illuminating the dark side of valuation using a Vanilla LSTM Recurrent Neural Network

One of the major problems faced by investors is to try and distinguish between “Price” and “value”, This problem arises because there are several behavioral biases as well as unethical practices that play a role while doing valuation. Sometimes, the valuation company is given a figure by their client and they do a backward calculation to keep up the pretense. The root cause for there even being a “Dark Side” of valuation is that in the DCF model, we make projected cash flows; These, projected cash flows are based on assumptions made by the valuation company. Now, based on their assumptions the valuation company could grow the cash flows at 100% or 1%, it’s perfectly acceptable as long as they have a story to back them up. Due to this ambiguity in projections, the valuation company provides their client with any valuation they want.

In this article, I have solved this problem by implementing an Artificial Recurrent Neural Network (Vanilla LSTM) to predict future cash flows. This gives us an unbiased prediction and takes away the ambiguity from a valuation that caused “The Dark Side”. The Artificial Recurrent Neural Network is able to detect interrelationships between thousands of diverse market variables and therefore is the perfect analytical tool for the financial forecast. In this article, I have used the Vanilla LSTM to forecast cash flows and arrived at a valuation of Maruti Suzuki Ltd and avoided any biases that usually pay a role while valuating a company.

What is a Recurrent Neural Network?

Recurrent Neural Network is a type of Neural Network where the output of the previous step is fed as an input of the current step. Usually in neural networks (feed-forward), the outputs and inputs are independent; But, in situations where you must predict the next word of a sentence, the previous word is essential. Recurrent Neural Networks solved this issue using hidden layers. The hidden layer remembers some of the information about a sequence. A Recurrent Neural Network remembers all the information over a period. It is considered as a powerful tool because of its ability to remember previous inputs. An RNN remembers each information through time. It is useful in time series prediction only because of the feature to remember previous inputs as well. This is called Long Short-Term Memory (LSTM). A Vanilla LSTM is an LSTM model that has only one hidden layer of LSTM units, and an output layer used to make a prediction.

- For forecasting Time series data Via a Vanilla LSTM Recurrent Neural Network, we are taking 10 data points or historical data. These data points are nothing but Net cash flows we arrive at while doing FCFE. Therefore, we start with getting Income statement and Profit and loss from FY 2010 to FY 2019.

- For each of these 10 years, we take the Profit after tax add the depreciation, Changes in Debt (Current year Debt – Previous years debt) and subtract the Capital expenditure and changes in working capital (Excluding cash). Using this, we arrive at Net Cash Flows of 10 years.

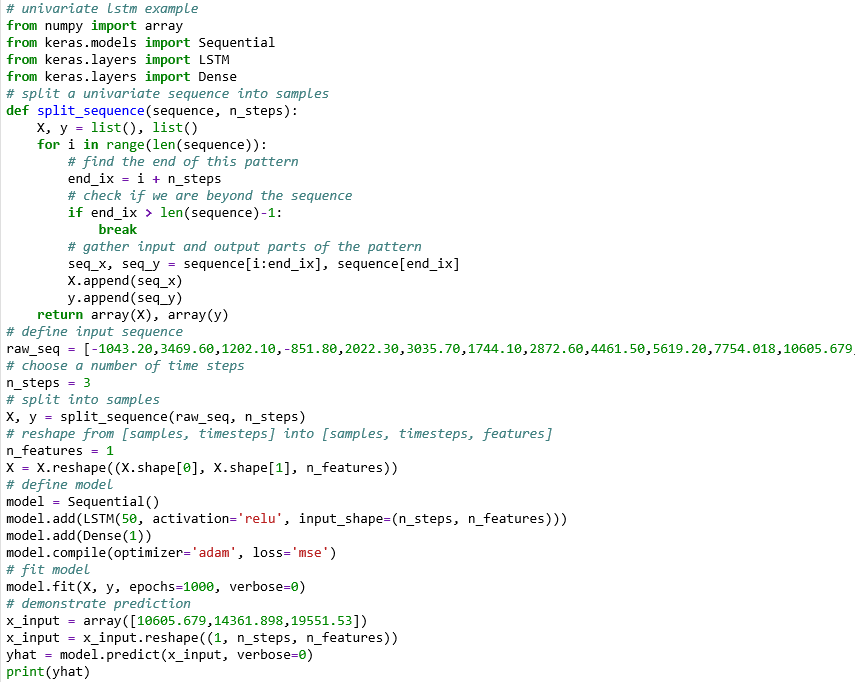

- These Net Cash Flows are used as Inputs for the Vanilla LSTM Recurrent Neural Network and are used to predict the future cash flows for the next 5 years. The code for this is written on Python by Dr. Jason Brownlee. Each time the neural network is used to predict the future net cash flows, it gives only one output (the net cash flow of the next year). This output is included in the input for the next year. This is how even though the neural network is capable of forecasting only 1 year, I have forecasted for the next 5 years. The Vanilla LSTM is as follows:

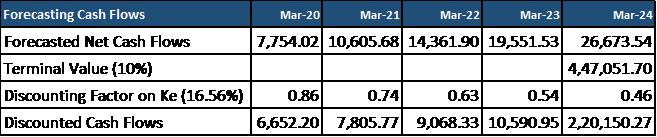

- The risk-free rate used in the Ke calculation is the difference between the 10 year Government security yield and the CDS spread of India (Data were taken from Bloomberg). The Beta is taken directly from Reuters. The Implied ERP is taken from Ashwat Damodaran’s website. The Rf is added to the multiplication result of the Implied ERP and the Beta.

- The terminal growth rate has been assumed at 10% because that is the rate at which the automobile sector is expected to grow as per Research Cosmo. However, to avoid any biases I have done a sensitivity analysis with terminal growth rates varying from 9% to 11%. To find the terminal value we increase the Net Cash flow value of the 5th year by the terminal growth rate and divide this by the difference between the Cost of Equity (Ke) and the terminal Growth rate.

- These discounted cash flows are added to arrive at Equity Value of the company. This equity value is divided to arrive at Expected market price of the company.

Conclusion

The objective of this article was to remove the assumptions made while valuation because these assumptions create a window for ambiguity which can be used to unethically inflate the valuation of the company. In this article no assumptions were made except the terminal growth rate (taken from a Research Cosmo Report). To tackle this, I have done a sensitivity analysis with terminal growth rates varying from 9% to 11%. Using this new model, we got a valuation at 10% terminal growth rate of Rs 8,417.22. Therefore, using the method I suggested in this article, you can find the “Value” of the company and not “price”. This way you save up on the money you would have paid the valuation company and also get a unbiased valuation.

Neil Jha

Team Leader – Fintech

(M.Sc. Finance, NMIMS – Mumbai. Batch 2018-20)

Connect with Neil on LinkedIn

THREE-WAY CONSOLIDATION OF BANKS

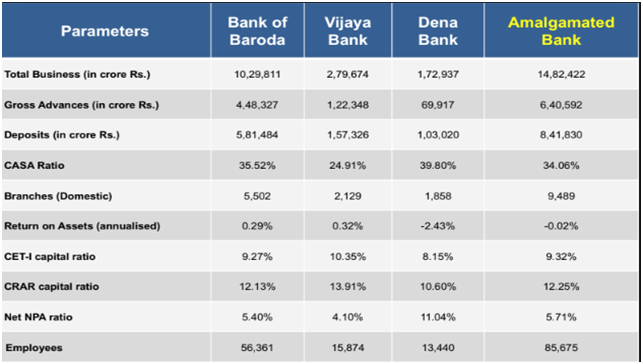

The union government agreed with the merger on Jan 2, 2019. Union Minister Ravi Shankar Prasad says the merger will allow the combined entity under Bank of Baroda being the leading power. This means that BOB will be the transferee bank and Dena bank and Vijaya Bank will be the transferor bank. After the merger BOB will be the third largest bank in India in terms of Assets after SBI and HDFC Bank. The merger will be completed by 1st April 2019. And after the Merger BOB will be the second largest public sector bank in India.

Merged Entity

The total business will rise from Rs. 10.3 trillion to Rs 14.8 trillion. The deposits will rise from Rs. 5.8 trillion to 8.4 trillion. The NPA will increase from 5.4% to 5.7% because as of now, the net NPAs with Dena bank is 11%.The financial of BOB will be diluted during the initial phrase of merger, mainly because of the bad loans of Dena Bank. Also, technology change, possible NPA (non-performing asset) provisions requirements etc. are likely to take a toll on near-term earnings of BoB” said Lalitabh Shrivastawa, assistant vice-president at Sharekhan. There is no retrenchment of any employee in the merged entity. But there are chances that some of the branches can be closed because of multiple presence in key locations.

Synergies

All the employees of Dena bank and Vijaya Bank will come under BOB. There will be no change in their services or working conditions. This merger will help to create a strong, global competitive bank with Economies of scale and enable realisation of wide ranging synergies. Because of enhance range of services, general public as a whole will be benefited. The government hopes that the economies of scale and wider scope would position the merged entity for “improved profitability, wider product offerings, and adoption of technology and best practices across amalgamating entities for cost efficiency and improved risk management, and financial inclusion through wider reach.”

Swap Ratio

The swap ratio has been finalised for both Dena bank and Vijaya Bank. According to the scheme of Amalgamation, the shareholder of Vijaya Bank will get 402 equity shares of BOB for every 1000 shares and in case of Dena Bank, people will get 110 shares for every 1000 shares. The swap ratio seems to be in favour of BOB. As according to the closing price as of 2nd January 2019, the ratio is 27% sharp discount for Dena Bank and for Vijaya Bank, it is at 6% discount.

Conclusion

The three banks have strengths of their own, which will help the merged entity. Dena Bank has relatively higher access to low cost current and savings accounts (CASA), Vijaya Bank is profitable and is well capitalized and BoB has extensive and global network, as well as good product offerings.

The amalgamated banks will have access to a wider talent pool and will have a large database that may be leveraged through analytics for competitive advantage in a rapidly digitalising banking context. There will be a flow of benefits because of wider reach and distribution network and there will be reduction in distribution costs for the products and services through subsidiaries.

Apoorva Goenka

Team Leader- Equity Research & Valuation

(MSc Finance, NMIMS Mumbai. Batch 2018-20)

Connect with Apoorva on LinkedIn